Happy Sunday!

Do you ever get carsick when you’re riding in the back of an Uber?

I’ve got good news for you!

You can’t get sick in flying taxis, and they’ll be at your service by 2024.

Two companies are making this claim, and they’re allowing you to invest as they go public via SPACs.

The first one is Joby Aviation—merging with Reid Hoffman’s blank check company Reinvent Technology Partners (NYSE: RTP).

Joby recently released the following video of their eVTOL (electric vertical take-off and landing) aircraft:

According to the company’s investor presentation, Joby expects each aircraft to cost $1.3 million to manufacture, with the potential to reduce that amount by half in the future. Joby also projects that each aircraft will generate $2.2 million in revenue. It assumes that every aircraft will fly 7 hours a day and spend 12 hours in operations — or 2,300 hours a year and 4,500 hours in operation — with an average of 2.3 passengers per trip.

Joby is also teaming up with their investor Toyota to launch an air taxi service.

Next, we have Archer Aviation. They, too, will be merging with a blank check company. This one is called Atlas Crest Investment (NYSE: ACIC).

Archer Aviation, the electric aircraft startup targeting the urban air mobility market, has landed United Airlines as a customer and an investor in its bid to become a publicly traded company via a merger with a special purpose acquisition company.

Here’s what Archer’s eVTOL aircraft will look like:

The fully electric vertical takeoff and landing aircraft is expected to travel distances of up to 60 miles at 150 mph using technology available today, transforming how people approach everyday life, work and adventure, while benefiting the environment and working towards a future zero-emissions world.

You can learn more about Archer’s mission here.

Let the air taxi wars begin!

Warehouse Robots

It’s tough to compete with Amazon.

They’ve built a ferocious moat when it comes to logistics and supply chain management.

They have more than 200,000 robots automating all aspects of order fulfillment across their warehouses.

So what if you’re not Amazon? How do you compete with 200,000 robots?

You team up with Berkshire Grey.

From their website:

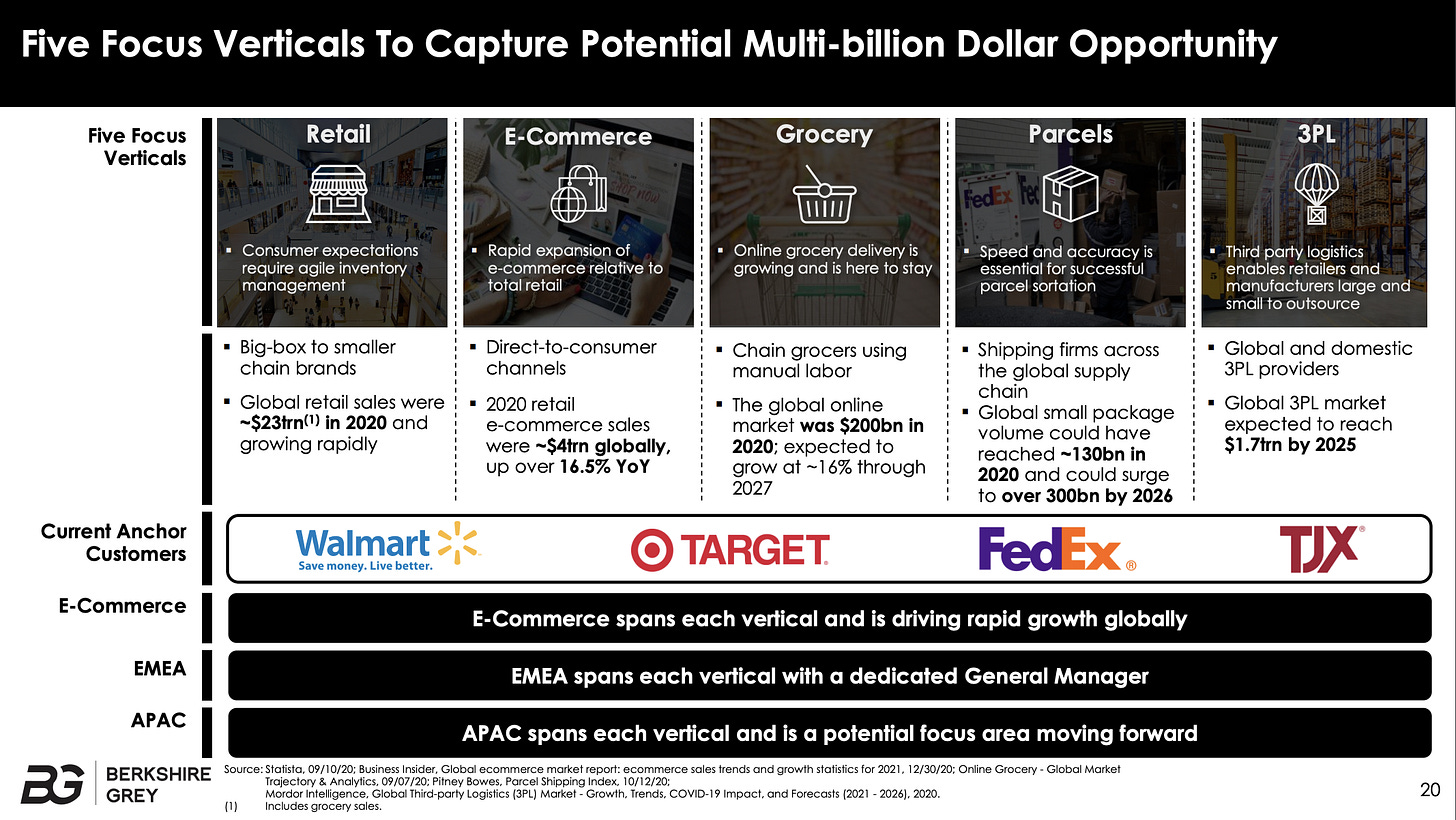

Berkshire Grey AI-Powered Robotics Automate Fulfillment

At Berkshire Grey, we build solutions that combine AI and Robotics to automate fulfillment in: RETAIL, eCOMMERCE, GROCERY & CONVENIENCE, POST & PARCEL, and 3RD PARTY LOGISTICS.By transforming pick, pack, and sort operations, our technology is a fundamental engine of change that moves you forward.

Translation: They give companies like Wal-mart and Target a fighting chance against Amazon.

Berkshire Grey is going public via a SPAC (NASDAQ: RAAC). Top-tier investors like Khosla Ventures back them, and Chamath is leading the PIPE.

Here’s his one-page investment thesis:

IPO?

With all the direct-listings and SPAC’s, it’s easy to forget about the good ol’ IPO.

Olo hasn't forgotten. They recently filed their S-1.

If Doordash is Amazon, then Olo is Shopify for restaurants.

The Olo platform includes 3 core modules:

Ordering: A fully-integrated, white-label, on-demand commerce solution, enabling consumers to order directly from and pay restaurants via mobile, web, kiosk, voice, and other digital channels.

Dispatch: A fulfillment solution, enabling restaurants to offer, manage and expand direct delivery while optimizing price, timing, and service quality.

Rails: An aggregator and channel management solution, allowing restaurants to control and syndicate menu, pricing, location data, and availability, while directly integrating and optimizing orders from third-parties into the restaurants’ point-of-sale, or POS, systems.

Olo has grown revenues by 94% over the last twelve months and most recently posted 118% YoY quarterly growth.

The only thing I like more than hypergrowth software companies is food, so I’m pretty pumped about the prospects of Olo.

Thanks for subscribing to Growth Compound.

If you're interested in reading my other articles, visit my blog.

Bardia